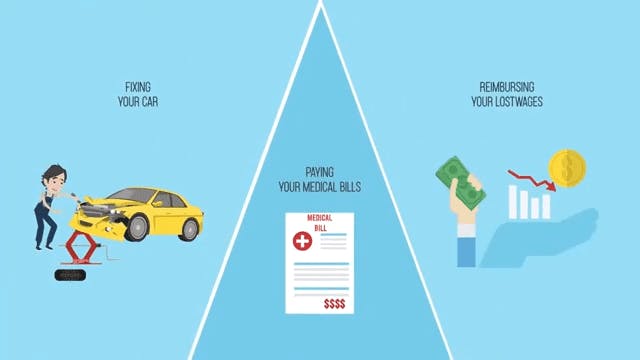

After a car crash, filing an insurance claim on the at-fault driver’s policy usually involves dealing with two different departments: the property damage department and the bodily injury department.

Insurance Claims

An insurance claim is a formal request by a policyholder to an insurance company for coverage or compensation for a policy event or covered loss: that’s the simple definition. When you file an insurance claim, you are effectively requesting that the insurance company review your claim and, upon approval, provide a payout to cover your loss or damage.

Unfortunately, it’s not always as simple as that, especially after an accident where you have been injured by another person’s negligence. In these cases, you need a qualified insurance claims lawyer on your side.